Building Improvements

This article discusses the process of determining what value to assign to Building Improvements when preparing a purchase price allocation study under ASC 805. This information is intended for financial reporting professionals who want to better understand the basics of valuation theory in this regard -- valuation professionals will seek a much more detailed and technical discussion.

For almost all real estate acquisitions, "building improvements" represent the largest concentration of value; typically 70% to 85% of the total purchase price. The value you want to record on the balance sheet is commonly described as the "building as if vacant," since the building would sell for less if it was vacant than it would when occupied. You also want to make sure your analysis considers the building in its current physical condition and not what it will be worth after identified capital improvements are made.

There are two generally accepted methods for calculating building value; the Income Approach and the Cost Approach.

Income Approach

With the income approach you are preparing a cash flow schedule starting with a hypothetically vacant building and then modeling all the revenues and expenses that would occur as the property leases up, becomes stabilized, and is eventually sold. Keep in mind that for opportunistic investments where you plan to make property improvements in order to increase rents or occupancy, you can run the analysis based on your improvement plans or based on the current condition -- just make sure your rent and vacancy assumptions match up with whatever you model for capital improvements. The assumptions for this cash flow schedule should be consistent with your property due diligence assumptions for future pro forma cash flows.

At the end of the analysis period, you will calculate your expected sale of the property, or reversionary event, by dividing the stabilized net operating income (NOI) by a market-supported terminal capitalization rate, and deducting typical costs of sale.

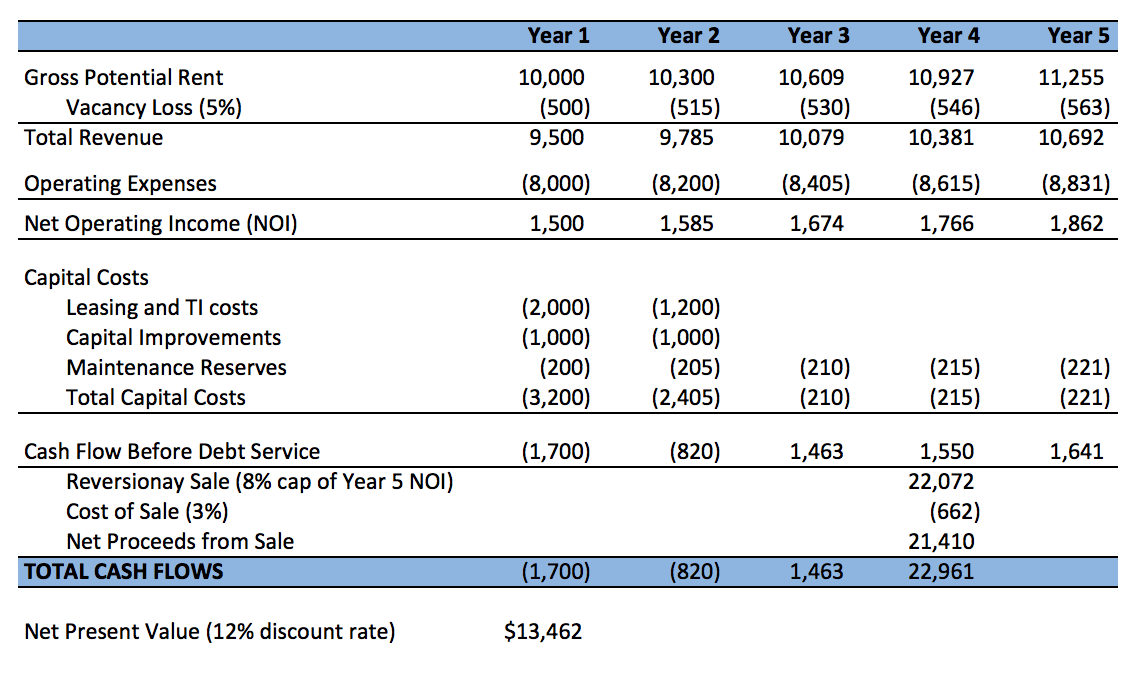

Here is a simplified example of what your cash flow schedule might look like. We are showing just a four-year hold here to conserve space. You will typically show a hold period of nine or ten years to be consistent with how most valuation professionals evaluate future cash flows. Keep in mind that the hold period is theoretical and has no relation to your actual business plan -- the important thing is that it matches up with how a typical investor might look at the deal.

Now that you have a cash flow schedule from vacant building through stabilization and reversion, you can calculate the net present value (NPV) of all those future cash flows, discounted by a discount rate consistent with the property type and location. This tells you what a typical investor would pay to acquire the property in a vacant state. Deduct your land and site improvement values (discussed on separate blog posts) and you are left with the building as if vacant.

Cost Approach

The cost approach is an alternate method that relies on estimating the depreciated replacement cost of the building. Construction cost estimating techniques are used to determine what it would cost to build a comparable building today. The Marshall & Swift Valuation Service cost manual is the most popular reference, especially among audit firms and appraisal shops.

Estimate the physical depreciation percentage, which is based on an estimate of the effective age divided by the useful life, in which effective age is generally less than the actual age as a result of periodic capital improvements and maintenance performed on the building over time.

Conclusion

The value of the two approaches should match within five percent or so. If not, continue to revisit the calculations in both approaches until they agree and select a final value supported by both approaches.